Where possibilities

begin

Gain new perspectives for your digital transformation. You can follow the blogs on this page to get latest information.

Revolutionizing Due Diligence: An In-Depth Exploration of Virtual Data Rooms for Enhanced Deal Transparency and Efficiency

Introduction:

In the dynamic landscape of business transactions and mergers, due diligence stands as a critical phase, shaping the success and viability of deals. The meticulous examination of financial, legal, and operational aspects has long been the bedrock of informed decision-making. However, as the global business ecosystem evolves, so too must the tools and methodologies employed in this investigative process.

This white paper delves into the transformative impact of Virtual Data Rooms (VDRs) on due diligence practices. Traditionally, due diligence has been a time-intensive and resource-demanding process, often hindered by logistical challenges, security concerns, and information silos. The advent of VDRs has emerged as a paradigm shift, promising heightened deal transparency, increased efficiency, and a redefined approach to information exchange.

As we navigate the nuances of this technological evolution, we aim to unravel the intricacies of VDRs and their role in reshaping the due diligence landscape. This exploration will encompass the core functionalities of VDRs, their security features, and their ability to facilitate seamless collaboration among stakeholders. By scrutinizing real-world case studies and industry examples, we will uncover the tangible benefits that organizations stand to gain from adopting VDRs in due diligence processes.

Join us on a journey through the intersection of technology and due diligence, as we uncover how Virtual Data Rooms are not merely tools but catalysts for a new era in deal-making—a realm characterized by transparency, efficiency, and informed decision-making.

This white paper embarks on a comprehensive exploration of how Dcirrus Company is revolutionizing the due diligence landscape. With a keen focus on reshaping the conventional norms, Dcirrus Company presents a suite of cutting-edge solutions designed to streamline and elevate the due diligence experience. From redefining data accessibility to fortifying security measures, the impact of Dcirrus on due diligence extends beyond mere facilitation—it stands as a cornerstone in the evolution of corporate transactions.

Our journey will traverse the distinctive features and capabilities that set Dcirrus Company apart, illustrating its capacity to facilitate seamless collaboration, enhance decision-making processes, and foster a new era of trust in deal negotiations. Drawing upon real-world use cases and success stories, we will unravel the tangible benefits organizations stand to gain by embracing Dcirrus Company as a transformative force in the due diligence realm.

Virtual Data Rooms (VDRs) emerged as a response to the challenges and inefficiencies associated with traditional due diligence processes, particularly in the context of mergers and acquisitions. The development of VDRs can be traced back to the late 1990s and early 2000s when the digital revolution began influencing various industries, including finance and legal.

Here’s a brief overview of how VDRs came into existence for due diligence:

Paper-Based Due Diligence:

Before the advent of VDRs, due diligence was a predominantly paper-based process. Physical documents, often stored in voluminous data rooms, posed logistical challenges and security concerns.

Conducting due diligence required physical presence, making it a time-consuming and resource-intensive endeavor.

Advancements in Digital Technology:

The rapid advancements in digital technology, particularly in data storage, security, and transmission, set the stage for a shift from paper to digital documentation.

Security Concerns and Information Control:

As deals became more complex, the need for enhanced security and controlled information access became apparent. Traditional methods were susceptible to leaks, and maintaining confidentiality during due diligence was a significant concern.

Birth of Virtual Data Rooms:

The concept of Virtual Data Rooms was introduced to address these challenges. VDRs are secure online repositories where sensitive documents can be stored, shared, and accessed by authorized parties.

The first generation of VDRs emerged in the early 2000s, providing a digital solution to streamline the due diligence process.

Key Features and Functionality:

VDRs were designed with features such as granular access controls, document tracking, and audit trails to enhance security and transparency.

These platforms facilitated remote access, allowing stakeholders from different locations to collaborate in real-time.

Market Adoption and Evolution:

Over time, VDRs gained widespread acceptance across industries involved in mergers, acquisitions, fundraising, and other complex transactions.

Continuous advancements in technology led to the evolution of VDRs, incorporating artificial intelligence, advanced analytics, and improved user interfaces.

Globalization and Remote Collaboration:

The increasing globalization of business operations and the rise of remote work further underscored the value of VDRs in enabling efficient, secure, and collaborative due diligence processes.

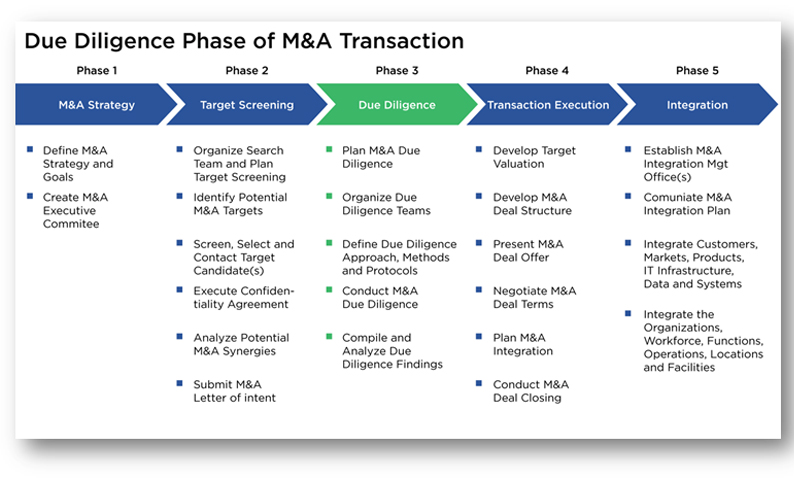

Due diligence in M&A transactions:

In the realm of M&A transactions, due diligence stands as a critical phase where the acquiring party meticulously scrutinizes the target company across multiple dimensions. Financial due diligence takes center stage, as the acquirer delves into the target’s financial statements, cash flow, and accounting practices to unearth potential risks and opportunities. Simultaneously, legal due diligence examines contracts, agreements, and litigation history to assess the target’s legal standing and compliance. Operational due diligence sheds light on the efficiency of the target’s operations, evaluating supply chains, production processes, and key personnel. Commercial due diligence ventures into market analysis, scrutinizing the target’s market positioning and competitive landscape. Strategic due diligence aligns the target’s business strategies with the acquirer’s long-term goals, ensuring strategic cohesion. Information technology due diligence assesses the target’s IT infrastructure and cybersecurity, while human resources due diligence examines workforce dynamics and potential HR-related liabilities. Environmental due diligence evaluates compliance with environmental regulations and potential environmental risks. The holistic findings from this comprehensive due diligence process empower the acquiring party to make informed decisions and navigate the complexities of integration successfully.

Influence of VDRs in M&A Due diligence:

Virtual Data Rooms (VDRs) have significantly influenced and transformed the landscape of M&A due diligence, offering a streamlined and secure platform for the exchange of sensitive information. One of the primary impacts is the acceleration of the due diligence process. Traditionally, physical data rooms and manual sharing of documents could be time-consuming and logistically challenging. VDRs facilitate real-time access to documents from anywhere in the world, allowing multiple stakeholders to collaborate efficiently.

The enhanced security features of VDRs play a crucial role in safeguarding sensitive information during M&A due diligence. With advanced encryption, access controls, and audit trails, VDRs provide a secure environment for sharing confidential documents, mitigating the risk of unauthorized access or data breaches. This heightened security not only protects the interests of both the buyer and the seller but also instills confidence among stakeholders.

Collaboration is another key aspect influenced by VDRs in M&A due diligence. These platforms enable seamless collaboration among diverse teams, including legal, financial, and operational experts. The ability to share information in real-time, coupled with features such as Q&A sections, ensures that all parties involved have access to the latest information and can collaborate effectively, even across different time zones.

VDRs contribute to increased transparency in the due diligence process. By providing a centralized repository for all relevant documents, VDRs allow for a more organized and structured review. This transparency facilitates better communication between the acquiring and target companies, reducing misunderstandings and fostering a smoother negotiation and integration process.

Moreover, the analytics and reporting capabilities of VDRs offer valuable insights into the due diligence process. Acquirers can track document access, analyze user behavior, and generate reports, providing a data-driven approach to decision-making. This not only enhances the efficiency of the due diligence process but also contributes to a more informed and strategic approach to M&A transactions.

In conclusion, VDRs have exerted a profound influence on M&A due diligence by expediting the process, enhancing security, fostering collaboration, increasing transparency, and providing valuable analytics. As technology continues to advance, the role of VDRs is likely to evolve further, shaping the future of M&A transactions and due diligence practices.

Due Diligence in Real Estate transactions:

In the realm of real estate transactions, due diligence is a pivotal process undertaken by buyers and sellers to ensure a comprehensive understanding of the property’s intricacies before finalizing a deal. This multifaceted investigation encompasses various facets, including a thorough examination of the property’s physical condition, title, and legal standing. Potential buyers often inspect the structural integrity, electrical systems, plumbing, and overall maintenance of the property to identify any issues that might require attention or negotiation. Simultaneously, legal due diligence involves scrutinizing property records, zoning regulations, and potential encumbrances to validate the property’s legal status. Environmental due diligence may also be conducted to identify any contamination risks or regulatory concerns associated with the property. The culmination of these investigations enables parties to make informed decisions, mitigating risks and fostering transparency in real estate transactions.

Impact of VDRs in due diligence in Real estate transactions:

Virtual Data Rooms (VDRs) have had a significant impact on due diligence processes in real estate transactions, streamlining and enhancing the efficiency of the traditional methods. Here are some key impacts:

- Improved Accessibility and Collaboration:

VDRs allow stakeholders, including buyers, sellers, lawyers, and other relevant parties, to access and review documents remotely. This enhances collaboration and eliminates the need for physical presence, making it easier for geographically dispersed teams to participate in the due diligence process.

- Improved Accessibility and Collaboration:

Virtual Data Rooms provide robust security features, including encryption, access controls, and audit trails. This ensures that sensitive information is protected, and administrators can monitor who accesses documents and track their activities. This heightened security is crucial when dealing with confidential real estate information.

- Version Control and Document Management:

VDRs help maintain version control of documents, reducing the risk of errors that may arise from outdated information. Centralized document management ensures that all stakeholders have access to the most current and accurate data, minimizing misunderstandings and discrepancies.

- Efficient Organization and Indexing:

VDRs provide tools for efficient organization and indexing of documents. This makes it easier for parties involved in due diligence to navigate through a large volume of information, locate specific documents, and focus on critical aspects of the transaction.

- Cost Savings:

The use of VDRs can result in cost savings compared to traditional due diligence methods that involve printing, courier services, and physical storage of documents. The electronic nature of VDRs reduces the need for physical paperwork and associated logistical expenses.

- Auditing and Reporting Capabilities:

Virtual Data Rooms offer robust auditing and reporting capabilities, allowing administrators to track user activity and generate detailed reports. This transparency is valuable in demonstrating compliance with regulatory requirements and providing a clear record of the due diligence process.

- Facilitation of Remote Transactions:

In situations where parties involved in a real estate transaction are unable to meet in person, VDRs enable the due diligence process to continue seamlessly. This flexibility is especially relevant in a globalized and interconnected business environment.

Due Diligence in Legal Firm:

In a legal firm, due diligence is a comprehensive and systematic investigation and analysis conducted by attorneys to assess and verify the legal aspects of a particular transaction, business, or case. It is a crucial process undertaken to identify potential legal risks, liabilities, and other relevant information that may impact the firm’s client. Due diligence plays a pivotal role in various legal contexts, such as mergers and acquisitions, real estate transactions, and corporate governance.

During due diligence, legal professionals scrutinize contracts, financial records, regulatory compliance, intellectual property, litigation history, and other pertinent documents and information. The objective is to provide the client with a clear understanding of the legal landscape surrounding the matter at hand, enabling informed decision-making. Through due diligence, legal firms aim to mitigate potential legal challenges, ensure compliance with applicable laws, and safeguard their clients’ interests. This meticulous process is a cornerstone of legal practice, fostering transparency and minimizing legal risks in a wide range of legal scenarios.

Enhancing Legal Due Diligence and Document Management: The Role of Virtual Data Rooms (VDRs) in Law Firms:

Virtual Data Rooms (VDRs) have become indispensable tools for law firms, transforming the landscape of legal due diligence and document management. In the realm of legal practice, where confidentiality and meticulous scrutiny are paramount, VDRs offer a secure and centralized platform for storing, sharing, and managing sensitive legal documents. This technology has proven particularly effective in complex legal processes such as mergers and acquisitions, where large volumes of critical information must be thoroughly examined.

One of the primary advantages of VDRs in law firms is their ability to streamline the due diligence process. By serving as a secure repository, VDRs facilitate the efficient organization and retrieval of pertinent documents, ensuring that legal professionals can access the information they need with ease. Moreover, these platforms offer robust features such as version control, enabling teams to track changes and maintain document integrity throughout the due diligence lifecycle. This level of document management sophistication not only enhances the accuracy of legal assessments but also contributes to the overall efficiency of the due diligence workflow.

The security features inherent in VDRs address the paramount concern of safeguarding confidential legal information. Law firms deal with highly sensitive data, and VDRs provide a controlled environment with advanced encryption, user permissions, and access tracking. This not only protects the interests of the law firm but also instills confidence in clients that their confidential information is handled with the utmost care. Furthermore, the real-time collaboration capabilities of VDRs empower legal teams to work collaboratively across different geographies, promoting seamless communication and accelerating the due diligence process.

As law firms continue to adapt to the evolving demands of the legal landscape, integrating VDRs into their workflows represents a strategic move towards efficiency, security, and enhanced client service. The role of VDRs in legal due diligence goes beyond mere document storage; it signifies a paradigm shift in how legal professionals approach complex transactions, emphasizing precision, collaboration, and the preservation of confidentiality in an increasingly digital era.

Asset Due Diligence:

Asset due diligence is a critical process conducted in various financial and business transactions, such as mergers and acquisitions, investments, or financing arrangements. During asset due diligence, individuals or entities meticulously evaluate the assets involved to gain a comprehensive understanding of their value, risks, and legal status. This multifaceted examination involves the identification and verification of assets, a thorough financial analysis, and a comprehensive review of the legal and regulatory landscape associated with the assets.

The first step in asset due diligence is often the identification and verification of assets. This includes confirming ownership, location and assessing the physical condition of tangible assets. For financial assets, such as investments or securities, a detailed review of financial statements and performance metrics is conducted to gauge their economic viability and potential impact on the overall financial health of the entity.

Legal due diligence is a crucial component of the process, involving a detailed examination of contracts, leases, licenses, permits, and potential legal disputes related to the assets. This aims to uncover any legal risks or liabilities associated with the assets and ensure compliance with relevant regulations. Additionally, regulatory compliance is assessed to confirm that the assets adhere to local, state, and federal regulations. Overall, asset due diligence provides stakeholders with the necessary information to make informed decisions, mitigate risks, and navigate transactions successfully.

Virtual Data Rooms: The Cornerstone of Efficient and Secure Asset Due Diligence:

1. Centralized Document Management: A fundamental function of a VDR is the centralized management of documents related to the asset being evaluated. It acts as a secure repository where all relevant documents, such as financial statements, contracts, and legal agreements, are organized systematically. This centralization streamlines the due diligence process, ensuring that all stakeholders have access to the most up-to-date and relevant information, thereby promoting a comprehensive evaluation of the asset.

2. Secure Information Exchange: Security is paramount in asset due diligence, and VDRs are designed to provide a secure environment for information exchange. Robust encryption, multi-factor authentication, and granular access controls ensure that sensitive data is protected from unauthorized access. This heightened security is especially crucial when dealing with confidential financial information, legal documents, and intellectual property associated with the asset.

3. Enhanced Collaboration and Communication: VDRs facilitate seamless collaboration among multiple parties involved in the due diligence process. Through features such as real-time document sharing, annotations, and Q&A forums, stakeholders can collaborate effectively, share insights, and communicate findings. This collaborative environment enhances the overall efficiency of the due diligence process, allowing for a more thorough analysis of the asset’s financial, operational, and legal aspects.

4. Accelerated Due Diligence Timelines: Virtual Data Rooms significantly contribute to expediting due diligence timelines. Unlike traditional physical document rooms, which require extensive coordination and logistics, VDRs enable instant access to documents from anywhere in the world. This not only reduces the time spent on document retrieval but also accelerates the overall due diligence timeline, enabling faster decision-making in transactions involving the evaluation of assets.

5. Audit Trail and Compliance Tracking: VDRs maintain a detailed audit trail of all activities within the platform, recording who accessed which documents and when. This feature is valuable for compliance purposes, providing a transparent record of the due diligence process. It ensures that organizations can demonstrate adherence to regulatory requirements and internal policies, offering a level of accountability that is crucial in asset transactions, especially in regulated industries.

In summary, the Virtual Data Room serves as a comprehensive solution for asset due diligence, offering centralized document management, secure information exchange, enhanced collaboration, accelerated timelines, and robust audit trail functionalities. These functions collectively contribute to a more efficient, secure, and transparent due diligence process in the evaluation of assets for various financial transactions.

Financial Due Diligence:

Financial due diligence is a critical process undertaken by businesses and investors to assess the financial health and risks associated with a potential investment or business transaction. This comprehensive examination involves reviewing financial statements, accounting records, and other relevant financial data to make informed decisions. The due diligence process typically consists of several key steps.

Firstly, financial analysts meticulously examine the target company’s financial statements, including balance sheets, income statements, and cash flow statements. This helps in understanding the historical financial performance, identifying trends, and evaluating the overall financial stability of the entity.

Secondly, analysts assess the quality and accuracy of the financial information provided. This involves verifying the authenticity of financial statements, scrutinizing accounting practices, and identifying any potential irregularities or discrepancies.

Thirdly, a thorough analysis of the company’s assets and liabilities is conducted. This includes scrutinizing the valuation of assets, assessing the level of debt, and evaluating the potential impact on the financial health of the business.

Additionally, financial due diligence extends to examining the target’s financial controls and risk management practices. Evaluating the effectiveness of internal controls helps identify potential areas of financial risk and ensures that the target has robust financial management processes in place.

In the final step, a comprehensive report is generated summarizing the findings of the financial due diligence process. This report aids decision-makers in understanding the financial implications of the investment, potential risks, and opportunities. Overall, financial due diligence is an essential tool in minimizing uncertainties and making well-informed financial decisions.

Unlocking Efficiency and Security: The Significance of Virtual Data Rooms in Financial Due Diligence:

In the fast-paced world of finance, where mergers, acquisitions, and various transactions occur frequently, the role of due diligence is paramount. Traditional due diligence processes, often reliant on physical document rooms and complex coordination, can be time-consuming, costly, and prone to security risks. This white paper explores the transformative impact of virtual data rooms (VDRs) on financial due diligence, highlighting their significance in enhancing efficiency and ensuring the highest standards of security.

Efficiency in Information Exchange: Virtual data rooms expedite the due diligence process by providing a centralized, online platform for sharing, reviewing, and analyzing documents. Stakeholders, regardless of geographical locations, can access the VDR simultaneously, reducing the need for physical presence and expediting the exchange of critical information. This enhanced efficiency translates to faster decision-making and an accelerated transaction timeline.

Enhanced Security Protocols: Security is a paramount concern in financial due diligence, where confidentiality and data integrity are non-negotiable. Virtual data rooms incorporate advanced security features such as encryption, multi-factor authentication, and granular access controls. These measures not only safeguard sensitive financial information but also instill trust among all parties involved in the due diligence process, fostering a secure environment for data exchange.

Collaboration and Transparency: VDRs promote collaboration among stakeholders by providing a collaborative workspace where teams can collaborate in real-time, discuss findings, and share insights. This transparency not only facilitates a more thorough analysis of financial data but also promotes a collaborative decision-making culture, essential in complex financial transactions.

In conclusion, the adoption of virtual data rooms represents a paradigm shift in financial due diligence. The efficiency gains, enhanced security measures, and improved collaboration capabilities make VDRs an indispensable tool in the financial landscape. As organizations strive to make well-informed financial decisions in an increasingly dynamic environment, the significance of virtual data rooms in financial due diligence cannot be overstated. Embracing this technology is not just about staying current; it is about unlocking a new era of efficiency, security, and collaboration in the world of finance.

Conclusion:

In conclusion, this white paper has explored the transformative impact of Virtual Data Rooms (VDRs) on the due diligence process, shedding light on how these secure online platforms are revolutionizing the way organizations approach information exchange and analysis. VDRs have emerged as a cornerstone technology in due diligence, offering a centralized and efficient solution for managing and sharing critical documents in a secure environment.

The core importance of VDRs in asset due diligence is evident in their ability to streamline workflows, accelerate timelines, and enhance collaboration among stakeholders. The heightened security features, such as encryption, multi-factor authentication, and detailed audit trails, instill confidence in users, addressing the paramount concerns related to data protection and compliance. As organizations navigate the complexities of financial transactions and asset evaluations, VDRs not only provide a technological edge but also contribute to a more transparent, accountable, and collaborative due diligence process.

The revolution brought about by VDRs in due diligence extends beyond mere efficiency gains; it signifies a paradigm shift in how businesses approach information sharing and decision-making. In embracing VDR technology, organizations are not only adopting a contemporary tool but are actively contributing to the evolution of due diligence practices, ensuring they remain agile, secure, and well-equipped to navigate the dynamic landscape of financial transactions. As we move forward, it is evident that VDRs will continue to play a pivotal role in shaping the future of due diligence, empowering organizations to make well-informed and timely decisions in an increasingly competitive and fast-paced business environment.

Dcirrus stands out as a leading company specializing in due diligence services, demonstrating an unparalleled level of professionalism in every aspect of their operations. With a wealth of expertise in the field, Dcirrus has established itself as a reliable partner for organizations seeking thorough and meticulous due diligence processes. The company’s commitment to excellence is reflected in its team of seasoned professionals who bring a comprehensive understanding of financial, legal, and operational intricacies to the table. Dcirrus not only leverages cutting-edge technologies but also adheres to the highest industry standards, ensuring that every due diligence engagement is conducted with the utmost precision and confidentiality. Their dedication to providing clients with actionable insights and facilitating well-informed decision-making underscores Dcirrus as a trusted name in the realm of due diligence, setting a benchmark for professionalism and reliability in the industry.

Latest Posts